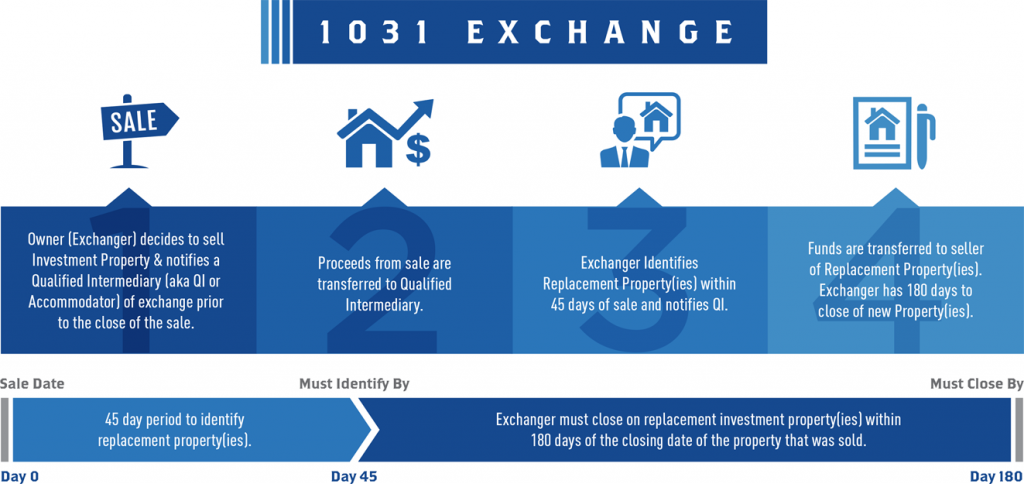

You ask, what is a 1031 Exchange? To put it simply the tax code allows for someone to defer all Capital Gain taxes on their investment property if they roll the proceeds of the sale into another property with the allowable time. The proceeds are held by a 3rd party during this time and then wired to the next escrow.

To understand the protection a 1031 exchange offers, consider the following example:

⦁ Assume an investor has $400,000 in gain and also $400,000 in net proceeds after closing. Assuming an investor with a $400,000 capital gain and incurs a tax liability of approximately $140,000 in combined taxes (depreciation recapture, federal capital gain tax, state capital gain tax, and net investment income tax) when the property is sold. Only $260,000 in net equity remains to reinvest in another property.

⦁ Assuming a 25% down payment and taking on new financing for the purchase with a 75% loan-to-value ratio, the investor would only be able to purchase a $1,040,000 replacement property.

⦁ If the same investor chose to exchange, however, he or she would be able to reinvest the entire gross equity of $400,000 in the purchase of $1,600,000 replacement property, assuming the same down payment and loan-to-value ratios.

As the above example demonstrates, tax-deferred exchanges allow investors to defer capital gain taxes as well as portfolio growth and improved return on investment. In order to access the full potential of these benefits, it is crucial to have a comprehensive knowledge of the exchange process and the Section 1031 code.

For instance, an accurate understanding of the key term like-kind – often mistakenly thought to mean the same exact types of property – can reveal possibilities that might have been dismissed or overlooked. McBride & Associates is your resource to obtain accurate information about the entire exchange process and ensure that you maximize your return on investment. We also recommend that you also speak to your tax professional as they will know what your basis on the property is so as the

What Qualifies for a 1031 Exchange?

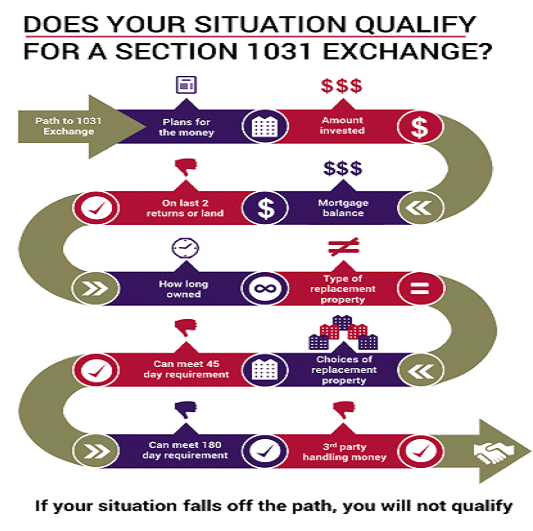

⦁ Plans for the money – The greatest benefit from capital gains deferral will be obtained by reinvesting all of the cash from the sale of your property. It is possible to extract cash at closing; however, the amount you take will be subject to tax.

⦁ Amount invested – How did you acquire the property and how long have you owned it? Did you purchase it, exchange into it? Was it given to you or did you inherit it? The answers to these and other questions will determine whether you have a low or high cost basis and what your exposure is to Capital Gains Taxes. If the tax to be paid is greater than $5,000, an exchange should be considered.

⦁ Mortgage balance – The outstanding mortgage debt is paid off at closing in the same manner as any other closing; and debt paid off must be replaced when the new property is acquired or new cash added to offset any difference. Any debt relief not offset by new cash will result in taxable boot.

⦁ On last two tax returns or vacant land – Your tax return provides the IRS with an audit trail of your past activity. Your rental property must have appeared on Schedule “E” of your return (or the corporate equivalent) if you want to portray your property as held for investment or for use in your Trade or Business. The only exception will be vacant land.

⦁ How long owned – Dealers are not permitted to use Section 1031. Generally their assets are “held for sale” not “held for investment”. In order for a property to be considered for long-term capital gain treatment, it must have been owned by you for at least one year, but 2 years is always recommended.

⦁ Type of replacement property – Section 1031 requires that the property be “like-kind”; all real property is like-kind to all other real property. The new tax code has impacted personal property, consult with your tax professional if you have questions about personal property.

⦁ Choices of replacement property – Under the simple rules, you may select up to three potential new properties and you can buy any one, two or all three of them. More choices are available; however the dollar value of the choices is capped at 200% of the value of the old property.

⦁ Can meet 45 day requirement – After the closing of the old or Relinquished Property, you will have 45 days to make your formal identification of Replacement Property choices. No substitutions are permitted after the 45th day. Having McBride & Associates knowing the rules and helping you align your escrows to the timeline is important to ensure your 1031 exchange completes as planned and correctly.

⦁ Can meet 180 day requirement – After the closing of the old or Relinquished Property, you will have 180 days to acquire the new or Replacement Property. Exchanges must be accounted for within the same tax year. Often it is necessary to extend the due date of the tax return to accomplish this task and to get the full benefit of 180 days for a year-end exchange.

⦁ Third party handling of money – Receipt of funds by the taxpayer at closing is not permitted in a Section 1031 Exchange. A Qualified Intermediary must be designated to facilitate this process so that the taxpayer never has constructive receipt of the funds. Relatives and attorneys or accountants that have represented the taxpayer in the last two years are prohibited from acting as the Qualified Intermediary. McBride and Associates will help you identify this intermediary as we interface with these people on a regular basis.

For your reference:

IRC Section 1031 (a)(1) states:

“No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment, if such property is exchanged solely for property of like-kind which is to be held either for productive use in a trade or business or for investment.”

IRS Reference:

https://www.irs.gov/newsroom/like-kind-exchanges-under-irc-code-section-1031